by Girish Anand | Oct 22, 2019 | ACA, Affordable Care Act, Obamacare

Today, the Centers for Medicare & Medicaid Services (CMS) announced that the average premium for the second lowest cost silver plan on HealthCare.gov for a 27 year-old will drop by 4 percent for the 2020 coverage year. Additionally, 20 more issuers will...

by Girish Anand | Oct 16, 2019 | ACA, Affordable Care Act, Obamacare

Judge Reed O’Connor of the Northern District of Texas has placed a nationwide injunction on the Obama-era regulation that prohibited insurers and health care providers who receive federal money from denying treatment to anyone based on sex, gender identity or...

by Girish Anand | Aug 30, 2019 | ACA, Affordable Care Act, Obamacare

According to the “medical loss ratio” provision of the Affordable Care Act (ACA, or Obamacare), insurers must rebate excess premiums by Sept. 30 each year. The estimated tab for this fall is approximately $1 billion, according to estimates, as refunds are...

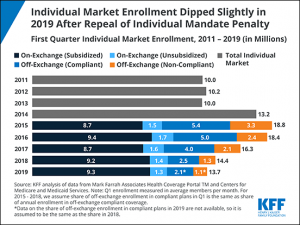

by Girish Anand | Aug 22, 2019 | ACA, Affordable Care Act, Obamacare

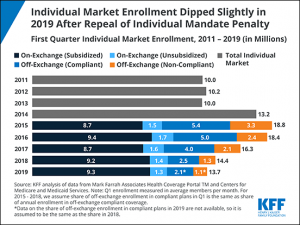

From a peak of 18.8 million in 2015 — the first year of Obamacare — the number of Americans enrolled in individual marketplace health insurance policies has dropped to 13.7 million, most of the decline stemming from the non-Obamacare exchanges. Following...

by Girish Anand | Aug 14, 2019 | ACA, Affordable Care Act, Obamacare

An analysis of health insurer rate filings with state commissioners shows that 2020 premiums for policies sold on the Affordable Care Act (ACA, or Obamacare) exchanges look to rise just 0.6 percent, according to a report by Healthcare Dive. Many states might actually...

by Girish Anand | Aug 13, 2019 | ACA, Affordable Care Act, CMS, Obamacare

From 2016 to 2018, 2.5 million customers who failed to qualify for a subsidy dropped their coverage under the Affordable Care Act (ACA, or Obamacare), a 40 percent falloff, according to data released Monday by the Centers for Medicare and Medicaid Services (CMS). “As...