by Girish Anand | Feb 23, 2010 | Random Musings

As reported here this past November when the Internal Revenue Service (IRS) announced its plans, the federal tax agency has commenced the first phase of its audit of 6,000 firms of all sizes and industries to root out abuses of executive pay, fringe benefits,...

by Girish Anand | Jan 20, 2010 | IRS

Strapped for cash, the Internal Revenue Service has announced plans to audit 6,000 businesses, both large and small, with a focus on worker misclassification, fringe benefits, reimbursed expenses, and executive compensation. If the IRS discovers personnel listed...

by Girish Anand | Jun 2, 2009 | IRS

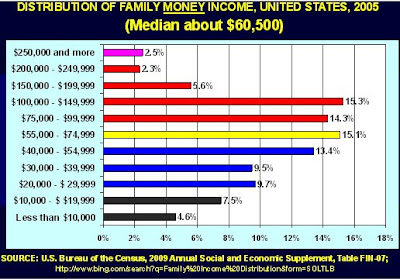

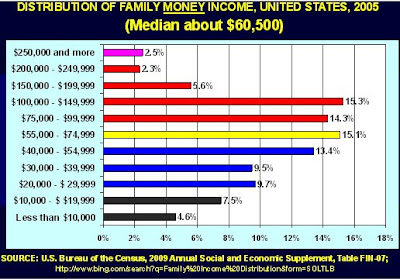

I found this (now-purloined) graph prepared by an economist writing about health care in the United States in the New York Times. His purpose was much different than mine. I’m reproducing it to show how politicians blatantly lie every time they say they’re...

by Girish Anand | Apr 15, 2009 | IRS

Now, if you think about it, there’s only one institution in our nation capable of wasting that many hours of people’s time…our good ol’ government. For the answer to what takes that long, think April 15. Yup, it takes all of us and our tax...

by Girish Anand | Mar 30, 2009 | IRS

A tax law doctrine known as “constructive receipt” could put those AIG employees who returned their bonuses in jeopardy of having to pay taxes on them anyway. Goes like this: Constructive receipt prevents people from gaming the system, say by performing...