by Editorial Staff | Oct 11, 2021 | COBRA, HHS, IRS

On October 7th, 2021, the Internal Revenue Service (IRS) issued guidance relating to COBRA continuation coverage deadlines. Also written by the Department of Treasury, Notice 2021-58 clarifies current COBRA coverage deadlines in connection with the COVID-19 pandemic....

by Editorial Staff | Aug 31, 2021 | Biden Administration, COBRA, IRS

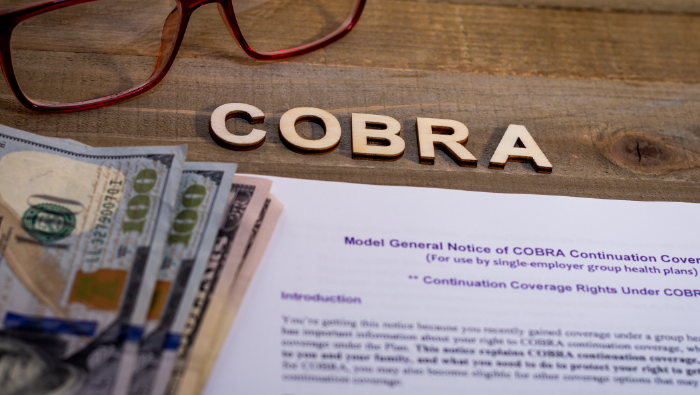

The Department of Labor (DOL) has issued a new notice to address upcoming expiring COBRA premium assistance for covered employees. Markedly, the Notice of Expiration of Period of Premium Assistance satisfies specific requirements under the American Rescue Plan Act...

by Editorial Staff | Aug 5, 2021 | COBRA, Employee benefit plans, IRS

On July 26th, 2021, the Internal Revenue Service (IRS) issued updated COBRA coverage guidance relating to tax breaks. Accordingly, the American Rescue Plan Act of 2021 (ARP) provides tax credits involving COBRA continuation health coverage. Specifically, under Notice...

by Editorial Staff | May 25, 2021 | COBRA, IRS

On May 18th, 2021, the Internal Revenue Service (IRS) issued COBRA continuation health coverage guidance relating to tax breaks. Accordingly, the American Rescue Plan Act of 2021 (ARP) provides tax credits involving continuation health coverage. Specifically, under...

by Editorial Staff | Apr 12, 2021 | COBRA, DOL, EBSA, Employee benefit plans

In early April, the U.S. Department of Labor (DOL) released two frequently asked questions (FAQs) documents on recent updates to COBRA and mental heath regulations. Included within the documents is information on updates to the Consolidated Omnibus Budget...

by Editorial Staff | Mar 30, 2021 | Biden Administration, COBRA, Employee benefit plans

Signed into law in March 2021, the American Rescue Plan Act (ARPA) includes free COBRA premiums. Specifically, the ARPA contains a 100% premium subsidy so eligible individuals can receive health insurance for up to six months. The assistance is available beginning...